Climate funds are everywhere right now

Last year the sector smashed records with $83.3B AUM – and this year's figures could be even higher.

But when it comes to impact, are all climate funds truly created equal?This month we did a deep dive into the sustainability space. In our new Elevate Impact series exploration, we show how savvy investors are evaluating clean-tech funds, plus we spotlight real examples from our own portfolio, and flag some potential warning signs.

We periodically share highlights from our trips to conferences and events.

IE VP Ander Iruretagoyena reports from the Impact Summit America, NYC:

"I was honored to be the keynote speaker at this event where I presented the critical due diligence process required for selecting external managers with strong impact capabilities. The case study covered how to evaluate impact measurement practices with the proprietary IE IMPACT framework, set tailored reporting standards, and implement effective tools like KPIs, covenants, and third party feedback loops. Real-world examples included a presentation of Impact Engine's investment in Quadria. The session concluded with a Q&A, sparking discussions on best practices and shared challenges."

IE CEO Jessica Droste Yagan files a dispatch from this year's Toniic Global Gathering in Cape Town, South Africa:

"I enjoyed catching up with other active impact investors from around the world. I continued to see focus on investing in climate and nature, with a lens of how we can also address poverty at the same time. Meeting local entrepreneurs, both for-profit and non-profit, was inspiring to see how much impact they are creating with so few resources."

IE CIO Priya Parrish writes in from the PEI Impact & Transition Summit in New York:

"I was on a buyout panel with Hailey Salito from Ascend, and other fund invests there were Next Billion, SER, and Core. It struck me that institutional investors continue to view impact themes as strong market opportunities for generating returns. Private equity is of particular interest from investors and is ripe to produce both strong impact and financial returns."

Carbon Direct, the sustainability management platform, is assisting JPMorganChase with its goal to reduce by 40% its Scope 1 and Scope 2 emissions with a target date of 2030. “Carbon Direct helps us pursue new investment opportunities in the voluntary carbon market with confidence,” JPMorganChase's Head of Operational Decarbonization Taylor Wright says.

CarbonDirect's Vice Chair Nili Gilbert (pictured), was also named on the TIME100Climate list.

Elvie, the wireless breast pump maker, was featured prominently in a Wall Street Journal article by Personal Tech columnist Nicole Nguyen. "Traditional pumps are bulky and loud," she writes. But by contrast, "The Elvie produces a pleasant, ticking sound. The quiet motor minimized disruptions to my sleeping baby. I’ve pumped during dinner parties, drives and, of course, tennis tournaments. Now that I’m back at work, it’s easy to tote my portable pumps to and from the office."

The review comes shortly after the release of Elvie's new Stride 2 model at a lower price than earlier products.

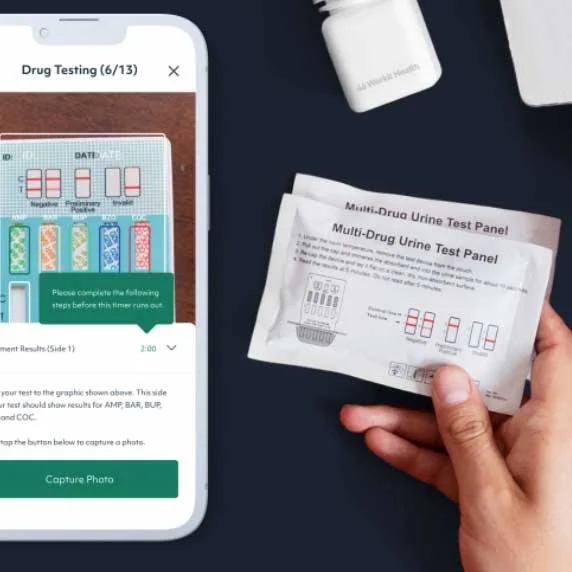

Workit Health, the addiction telehealth service, expanded into New Mexico this month. According to the New Mexico Department of Health, the state consistently has the highest rate of alcohol related deaths in the US. Workit currently has opioid and alcohol recovery clinics in six states, and a plan to expand into four more is in the works.