By Tasha Seitz

At Impact Engine, our goal is to engage current and prospective impact investors in order to build a strong impact investing community around early stage companies. In our conversations with investors, we run across a lot of different ideas about what impact investing is and isn’t, so we wanted to take the time to share our preferred definition and viewpoint. We asked our Partner, Tasha Seitz, to share her thoughts on the topic. As we grow our community of investors, we believe that it is important to understand the motivations and opportunities to achieve both financial return and sustainable social impact.

The Definition of Impact Investing

There has been a lot of debate over the years about definitions, but we happen to like the one published by the World Economic Forum:

“Impact investing is an investment approach intentionally seeking to create both financial return and social impact that is actively measured.”

The emphasis is ours: the two key elements of impact investing (in addition, of course, to their potential to generate both financial return and social impact) are intentionality and measurement.

Impact investments can be made directly in companies or nonprofits, or indirectly in funds managed by professional fund managers that have embraced social or environmental impact. They can come in the form of debt, equity, real assets or financial guarantees. Impact is not an asset class itself, but a theme that can be applied across asset classes, geographies, and sectors. Impact investments can target financial returns that are below market, consistent with market, or above market, depending upon the strategy and motivations of the investor.

Investment vs. Philanthropy Mindsets

At a high level, we find that people tend to initially approach impact investing from one of two lenses:

Social impact as a lens to evaluate and select investments and align financial portfolio with personal values, and/or

Investing as a tool to bring greater resources/efficacy to bear in pursuing philanthropic goals.

Some people use both of these lenses, depending upon the specific opportunity and pool of money they are investing from, and over time they tend to get more sophisticated in how they blend lenses. Understanding which lens an individual or organization is using is critical to understanding language and priorities, and ultimately to create alignment among investors, managers, and executives.

The Appeal of Impact Investing

Charitable giving in the United States has historically been about $390 billion per year. In contrast, there is $80 trillion in assets under management, of which almost 50 percent resides in North America. The World Economic Forum report cited earlier projected that impact investing would grow to over $500 billion in 2020.

Graph is not to scale.

Creating social impact through investment vehicles has the potential to dramatically increase the numbers of dollars at work creating positive impact, and thus the appeal to philanthropically motivated investors.

Also, increasingly, financially motivated investors are seeing impact as a smart “lens” to view their investments, and for a variety of reasons.

First, investors are starting to view their financial portfolio and their philanthropic giving as a system. Investing in fossil fuels, for example, while simultaneously donating to environmental causes means that the dollars in the financial portfolio are working against dollars in the philanthropic allocation.

Second, an increasing number of investors view it as “good business” for companies to incorporate positive social and environmental practices into their operations — and that those companies will create more value for investors over time.

Third, investors see big financial opportunity connected to impact: PwC’s megatrend analysis points to several trends that suggest health care, education, urbanization, the rise of emerging economies, and climate change will be among the biggest challenges and opportunities in the coming years.

Last, but not least, more and more individual investors are seeking to align their financial portfolios with their personal values.

Where Impact Investing Fits

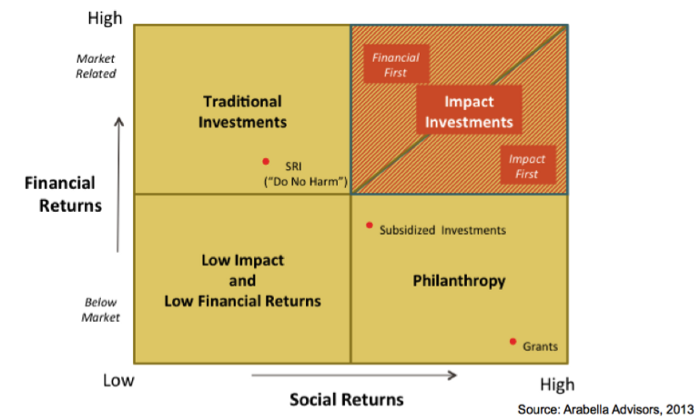

We find it helpful to look at impact investing and its relationship to both traditional investing and traditional philanthropy in the context of a two-by-two matrix, along the dimensions of financial return and social impact.

Traditional investments are typically made without regard to social impact, and philanthropic contributions are generally made without consideration of financial returns. Impact investing incorporates “both/and” thinking, and as the graphic makes clear, represents a spectrum of both financial returns and potential for social impact. While there are clearly many investment opportunities that prioritize impact over returns, and many that prioritize financial returns over impact, there are a growing number of people (including Impact Engine) that believe there are opportunities to invest in funds, organizations, and companies with the potential to provide attractive financial returns that grow in lock-step with their impact — the upper right quadrant of the upper right quadrant.

Spectrum of Capital

Our friends at Bridges Ventures articulated the following spectrum of impact capital:

Traditional investments lie on the left of this continuum and traditional philanthropy on the right. Over the last several decades, impact-motivated investors have started to move towards the right, incorporating consideration of social impact into investment decisions. Responsible investing applies a negative screen on harmful products (e.g., alcohol, tobacco, firearms, fossil fuels) and may also include consideration of a broader range of factors from a risk management perspective (e.g. use of child labor, sweatshops, pollution). Sustainable investing, which takes impact considerations to the next level, applies a positive screen, selecting investments based on proactive, positive environmental, social, and governance (ESG) factors.

The highest impact opportunities lie in directly addressing issues and markets where a social or environmental need creates a business opportunity — some have the opportunity to beat the market and generate alpha; others require some financial trade-off in order to generate the desired impact.

Impact Engine’s Perspective

In our fund, we seek investment opportunities that have the potential to drive both competitive financial returns and sustainable, scalable social or environmental impact. We look for business models where the impact is baked into the company’s product or service so that financial and social return grow hand-in-hand over time.

In our network of investors, however, we see a broad array of motivations and approaches. Many in our investor community share our same lens, but others invest in our companies purely based on belief in a company’s potential for impact (e.g. the Gates Foundation grant to ThinkCERCA) or purely based on a belief in a company’s potential to generate attractive financial returns (e.g. Chicago Ventures, KGC Capital, and OCA Ventures’ investment in Pangea).

We embrace all of these investors to the extent that their funding is supporting the hand-in-hand model we so strongly believe in, but we especially want to support those who are seeking to use impact investing intentionally for the reasons stated above.

Members of the Impact Engine community are already doing fascinating work along the impact spectrum, from social impact bonds, to custom-designed values-based public equities portfolios designed to track to the market indices, to microfinance. In some cases, the same individual is embracing multiple points on the spectrum. For example, IDP Foundation is bringing entrepreneurial, business-oriented approaches to their grant making to spur a market for sustainable funding for rural schools in Ghana while investing the corpus of the foundation in impact funds with broader areas of focus to generate market-rate returns.

We are actively working to support the increasing interest in impact investing and the growing number of impact investors in our community. While impact priorities and investing strategies can be very unique to the individual, we believe anyone and everyone can take steps, large or small, to deploy their capital more effectively and intentionally to drive financial success while driving impacts that bring us closer to the world we would like to live in. Every dollar has an impact — let’s make it positive.

Did you like this post? Sign up for our newsletter and we’ll send you the latest impact investing and Impact Engine news each month.